The IRS takes this distinction very seriously.

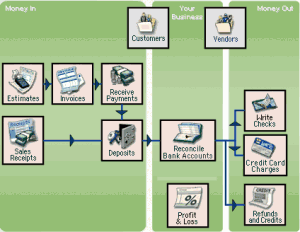

You’ll also need to make certain that the person you’re hiring is indeed an independent contractor and not an employee. It’s much easier than hiring a full-time employee, but it still takes some knowledge of how QuickBooks Online handles these individuals. If you’re thinking about taking on a contract worker, you, too, will have to educate yourself on the paperwork and processes required to comply with the IRS’ rules for his or her compensation. Whether they chose to, or circumstances forced them to, these new entrepreneurs had to learn new ways to get paid and to prepare their income taxes. The COVID-19 pandemic created millions of self-employed individuals and small businesses.

Are you taking on a worker who’s not an employee? QuickBooks Online includes tools for tracking and paying independent contractors.

0 kommentar(er)

0 kommentar(er)